The U.S. market has long been critical to Mexico—not only to its manufacturing sector, but to its overall economic strength. When Mexico signed the North American Free Trade Agreement (NAFTA) nearly two decades ago, the greater access it provided to the U.S. market was a boon to the country's manufacturing base

, whose share of the country's GDP grew by almost 4 percentage points in the five years following the signing of the treaty. In turn, Mexico's share of the U.S. manufactured goods import market increased from slightly above 7 percent in 1994 to nearly 13 percent in 2001.

But Mexico's fortunes changed dramatically after China joined the World Trade Organization (WTO) in 2001. WTO membership reduced many barriers to Chinese exports. China's low-cost manufacturing base and ample production capacity enabled it to compete head-on and significantly undercut Mexico's export share in the U.S. market, despite the trade preferences Mexico received under NAFTA. Between 2001 and 2005, Chinese manufacturing exports to the United States expanded at an average annual rate of 24 percent, while Mexico's export growth decelerated sharply from about 20 percent a year to 3 percent on average each year over the same period. As a result, China's share of U.S. manufacturing imports almost doubled by 2005, eroding the previous gains in market share by Mexico (see Chart 1).

But Mexico's fortunes changed dramatically after China joined the World Trade Organization (WTO) in 2001. WTO membership reduced many barriers to Chinese exports. China's low-cost manufacturing base and ample production capacity enabled it to compete head-on and significantly undercut Mexico's export share in the U.S. market, despite the trade preferences Mexico received under NAFTA. Between 2001 and 2005, Chinese manufacturing exports to the United States expanded at an average annual rate of 24 percent, while Mexico's export growth decelerated sharply from about 20 percent a year to 3 percent on average each year over the same period. As a result, China's share of U.S. manufacturing imports almost doubled by 2005, eroding the previous gains in market share by Mexico (see Chart 1).

China was able to crowd out Mexican exports in the U.S. market because Mexico lost its advantage in several labor-intensive manufacturing sectors in which it specialized—including apparel, office machinery, furniture, and photographic and optical equipment. Looking for cheaper labor, many of these manufacturers, including those in the famed maquiladora industries (which assemble mostly imported parts into finished products for export to the United States), relocated their operations from Mexico to China.

But almost as quickly as it stumbled, Mexico regained its footing and began to claw its way back. Over the past seven years, Mexican manufacturing exports rose from about 11 percent of the U.S. import market to an all-time high of 14.4 percent—at first elbowing out such competitors as Japan and Canada, but in recent years gaining market share at the expense of China. Between 2005 and 2010, both Mexico and China gained market share in the United States. Since 2010, however, Mexico's gains in the U.S. import market coincided with a decline in China's market participation.

The return of Mexico

Mexico's rebound has been driven primarily by exports of electronics, telecommunications, and transportation equipment. Since 2005, Mexico's share of U.S. imports of transportation and communications products increased steadily to 18 percent, accounting for 76 percent of total Mexican manufacturing exports in the first half of 2012. But starting in 2009, most manufacturing sectors—20 of the 26 manufacturing import categories—showed gains, jointly accounting for 80 percent of total Mexican exports. Only a handful of industries lost market share, including electrical equipment (still a major sector, accounting for 14 percent of Mexican exports) and apparel.

The automotive sector has contributed the most to the increase in aggregate market share, explaining half of the rise between 2005 and 2012. Mexico's market share in U.S. imports of autos, auto parts, and accessories (excluding trucks) increased almost 9 percentage points over this period, particularly since 2009. Mexico accounts for a fifth of the total U.S. imports of autos and auto parts—the second-biggest foreign supplier of auto-related products to the United States, close behind Canada. The automotive sector accounts for one-quarter of all Mexican manufacturing exports to the United States. This large increase in production capacity and exports has been underpinned by a continued flow of foreign direct investment into the sector—mostly from the United States, but recently also from Japan and Germany.

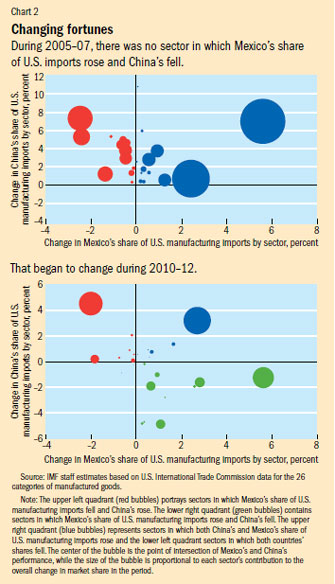

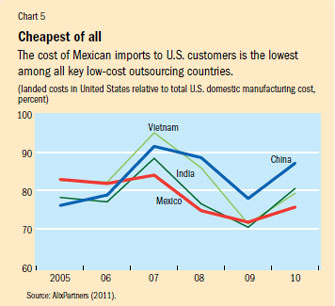

Chart 2 shows the changes in Mexico's market share of U.S. imports against those of China in each of the 26 manufacturing sectors, for the periods 2005–07 and 2010–12. We excluded 2008 and 2009 because the global economic crisis distorted trade worldwide. In each panel, the upper left quadrant (red bubbles) represents sectors in which China's market share increased while Mexico's fell; the lower right quadrant (green bubbles) plots sectors (if any) in which Mexico's share increased and China's fell. The other two quadrants depict sectors in which the shares for both countries either fell or increased simultaneously. The size of the bubbles is proportional to each sector's contribution to the overall change in market share in each period. During 2005–07 (top panel) there was no sector in which Mexico's share increased and China's simultaneously decreased. In fact, Mexico was losing share in several sectors in which China was gaining participation. In contrast, during 2010–12 (bottom panel) there are several sectors in which Mexico's share increased while China's fell. In addition, the number and relative importance of sectors in which China's share went up and Mexico's declined in the most recent period.

Chart 2 shows the changes in Mexico's market share of U.S. imports against those of China in each of the 26 manufacturing sectors, for the periods 2005–07 and 2010–12. We excluded 2008 and 2009 because the global economic crisis distorted trade worldwide. In each panel, the upper left quadrant (red bubbles) represents sectors in which China's market share increased while Mexico's fell; the lower right quadrant (green bubbles) plots sectors (if any) in which Mexico's share increased and China's fell. The other two quadrants depict sectors in which the shares for both countries either fell or increased simultaneously. The size of the bubbles is proportional to each sector's contribution to the overall change in market share in each period. During 2005–07 (top panel) there was no sector in which Mexico's share increased and China's simultaneously decreased. In fact, Mexico was losing share in several sectors in which China was gaining participation. In contrast, during 2010–12 (bottom panel) there are several sectors in which Mexico's share increased while China's fell. In addition, the number and relative importance of sectors in which China's share went up and Mexico's declined in the most recent period.

We calculated the fraction of Mexico's increase in market share that can be associated with China's reduction, controlling for changes in the shares of the other competitors (based on a methodology developed by Jorge Chami Batista, 2008). During 2010–12, 40 percent of Mexico's dollar gains in the sectors in which it increased market share can be attributed to China's loss of share—some of which could reflect China's shift to exports of a different set of goods. Mexico's largest gains over China in market share were in a diverse range of goods—including electrical machinery and building materials. In contrast, during 2005–07, half of Mexico's increase in market share is explained by reductions by Canada and Japan and none by China.

Mexico's increased competitiveness

Mexico's comeback in the U.S. market reflects both its improved competitiveness and developments that are making Chinese exports relatively more expensive. Most important among these developments are a narrowing gap in labor costs between Mexico and China, increased productivity gains in Mexico, and rising transoceanic shipping costs. Mexico's protection of proprietary rights and commitment to free trade also play a role in encouraging manufacturers to locate there.

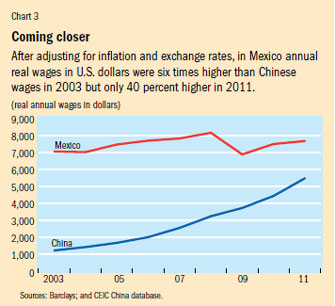

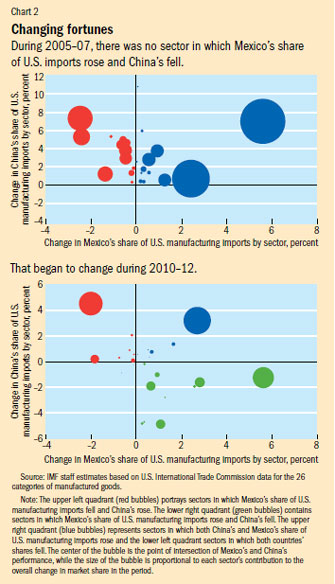

Wages in the manufacturing sector in China increased at an average annual rate of 14 percent in renminbi terms from 2003 to 2011, and close to 20 percent annually in dollar terms (which reflects both nominal wage growth and the appreciation of the Chinese currency). In contrast, average wages in the Mexican manufacturing sector have remained fairly constant in dollar terms, underpinned by moderate wage growth and a depreciation of the peso. In 2003, average dollar wages in Mexico were six times higher than those in China; in 2011 wages were only 40 percent higher (see Chart 3). This has reduced the competitive advantage that China had as a low-cost supplier of manufacturing goods to the United States in the early part of the 2000s. (Because reliable data on unit labor costs in the Chinese manufacturing sector are not available, we could not account for changes in productivity in manufacturing and how much they contributed to wage changes.)

Wages in the manufacturing sector in China increased at an average annual rate of 14 percent in renminbi terms from 2003 to 2011, and close to 20 percent annually in dollar terms (which reflects both nominal wage growth and the appreciation of the Chinese currency). In contrast, average wages in the Mexican manufacturing sector have remained fairly constant in dollar terms, underpinned by moderate wage growth and a depreciation of the peso. In 2003, average dollar wages in Mexico were six times higher than those in China; in 2011 wages were only 40 percent higher (see Chart 3). This has reduced the competitive advantage that China had as a low-cost supplier of manufacturing goods to the United States in the early part of the 2000s. (Because reliable data on unit labor costs in the Chinese manufacturing sector are not available, we could not account for changes in productivity in manufacturing and how much they contributed to wage changes.)

We also found that during 2010–12, Mexico gained market share relative to China in sectors in which labor played a bigger role than capital, such as in the manufacture of furniture and of plumbing, heating, and lighting fixtures. This appears consistent with the notion that Mexico's recent gains in market share vis-à-vis China were driven in part by improved relative labor costs. In contrast, there was no systematic relationship between changes  in relative market share and the relative importance of labor in the production process.

in relative market share and the relative importance of labor in the production process.

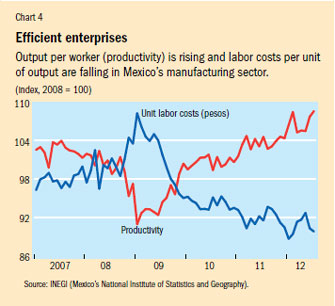

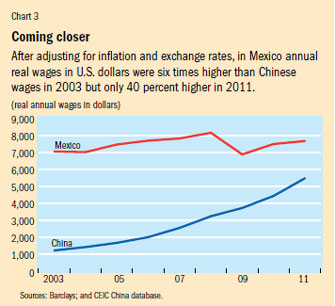

In addition, strong productivity increases underpinned by significant investment in the manufacturing sector in Mexico have helped lower the cost of labor per unit of output and increase the competitiveness of manufacturing production (see Chart 4).

Locational luck

Mexico has also benefited mightily from being close to the United States. The price of oil increased from $25 a barrel in the early 2000s to more than $100 in February 2013, which substantially raised transoceanic freight costs. This proximity has given Mexico a competitive edge over China, particularly when it comes to trendy time-sensitive goods and heavy and bulky items.

For example, in 2009 Mexico became the world's leading exporter of flat-screen TVs, surpassing South Korea and China. According to the Global Trade Atlas (Global Trade Information Services), the country is also the leading manufacturer of two-door refrigerators. Proximity, as a proxy for speed-to-market, has also gained importance because U.S. companies increasingly buy inputs (such as parts) rather than making them and, to hold down the costs of maintaining inventory, have adopted just-in-time manufacturing—which requires precise and timely delivery of those inputs. That is far easier for Mexican suppliers to achieve.

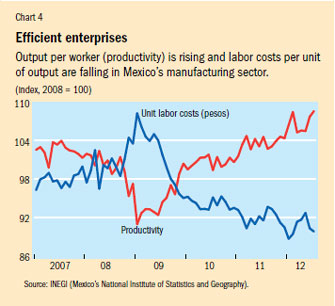

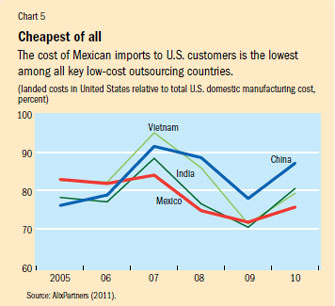

Chart 5. Cheapest of all

According to the 2011 U.S. Manufacturing-Outsourcing Cost Index (AlixPartners, 2011), goods produced in Mexico had the lowest landed costs (that is, their price at a California port) for U.S. importers in 2010 of all key low-cost outsourcing countries (see Chart 5). At the same time, U.S. producers have begun to "near-shore" their inputs—that is, buy them from a close, rather than distant, source, which enhances Mexico's advantage as a nearby manufacturing hub. Non-U.S. companies have also pulled up stakes in China and relocated their production to Mexico.

According to the 2011 U.S. Manufacturing-Outsourcing Cost Index (AlixPartners, 2011), goods produced in Mexico had the lowest landed costs (that is, their price at a California port) for U.S. importers in 2010 of all key low-cost outsourcing countries (see Chart 5). At the same time, U.S. producers have begun to "near-shore" their inputs—that is, buy them from a close, rather than distant, source, which enhances Mexico's advantage as a nearby manufacturing hub. Non-U.S. companies have also pulled up stakes in China and relocated their production to Mexico.

Mexico's strong commitment to the protection of proprietary technologies has also helped it attract foreign direct investment, with its beneficial impact on efficiency. Mexico has a strong reputation for protecting international intellectual property, patent, and trademark rights and is a party to several international treaties, including the World Intellectual Property Organization Copyright Treaty. This has helped minimize the risk of piracy, counterfeiting, and other intellectual property infringements, which is especially important in high-technology sectors and in manufacturing sectors whose technologies have military applications. In January 2012 Mexico joined the Wassenaar Arrangement on Export Controls for Conventional Arms and Dual-Use Goods and Technologies, which opened up new possibilities for U.S. and European firms to invest in high-tech sectors in Mexico, including those that involve semiconductors, software, aerospace, lasers, sensors, and chemicals.

Mexico's manufacturing base has also been buttressed by the economy's openness. Mexico's trade agreement network is one of the world's largest; it has free trade or preferential trade agreements with 44 countries and has shown a strong commitment to avoiding the use of trade restrictions and ensuring unrestricted access to markets and intermediate inputs to companies operating in Mexico. Moreover, Mexico has signed international standards and quality agreements that facilitate the participation of local manufacturing companies in global supply chains, particularly in the automotive and aerospace industries.

A number of the factors that have contributed to Mexico's increased competitiveness and its recovery of U.S. market share are likely to be long lasting—or structural, as economists say. These include the locational advantage, improved unit labor costs from enhanced manufacturing productivity and increased labor participation, and trade openness that appear to have underpinned Mexico's improved competitiveness in the U.S. market in recent years. Nevertheless, China is expected to remain a low-cost manufacturing powerhouse for many goods the United States imports because of its mature manufacturing capability and the significant switching costs of moving production overseas (AlixPartners, 2011). For this reason, structural reform efforts in Mexico to further boost productivity and investment would help sustain the dynamism of manufacturing exports and boost potential GDP growth. These efforts should include such things as taking measures to increase competition and labor flexibility, improve education, and strengthen the rule of law.

Manufacturing in Mexico was hit hard by China's rise on the global stage at the beginning of the past decade; but today, as some of China's cost advantage has eroded, Mexico's manufacturing sector is among the best positioned to benefit from the changing global landscape.

Source: International Monetary Form

Finance & Development, March 2013, Vol. 50, No. 1

Herman Kamil and Jeremy Zook

But Mexico's fortunes changed dramatically after China joined the World Trade Organization (WTO) in 2001. WTO membership reduced many barriers to Chinese exports. China's low-cost manufacturing base and ample production capacity enabled it to compete head-on and significantly undercut Mexico's export share in the U.S. market, despite the trade preferences Mexico received under NAFTA. Between 2001 and 2005, Chinese manufacturing exports to the United States expanded at an average annual rate of 24 percent, while Mexico's export growth decelerated sharply from about 20 percent a year to 3 percent on average each year over the same period. As a result, China's share of U.S. manufacturing imports almost doubled by 2005, eroding the previous gains in market share by Mexico (see Chart 1).

But Mexico's fortunes changed dramatically after China joined the World Trade Organization (WTO) in 2001. WTO membership reduced many barriers to Chinese exports. China's low-cost manufacturing base and ample production capacity enabled it to compete head-on and significantly undercut Mexico's export share in the U.S. market, despite the trade preferences Mexico received under NAFTA. Between 2001 and 2005, Chinese manufacturing exports to the United States expanded at an average annual rate of 24 percent, while Mexico's export growth decelerated sharply from about 20 percent a year to 3 percent on average each year over the same period. As a result, China's share of U.S. manufacturing imports almost doubled by 2005, eroding the previous gains in market share by Mexico (see Chart 1). Chart 2 shows the changes in Mexico's market share of U.S. imports against those of China in each of the 26 manufacturing sectors, for the periods 2005–07 and 2010–12. We excluded 2008 and 2009 because the global economic crisis distorted trade worldwide. In each panel, the upper left quadrant (red bubbles) represents sectors in which China's market share increased while Mexico's fell; the lower right quadrant (green bubbles) plots sectors (if any) in which Mexico's share increased and China's fell. The other two quadrants depict sectors in which the shares for both countries either fell or increased simultaneously. The size of the bubbles is proportional to each sector's contribution to the overall change in market share in each period. During 2005–07 (top panel) there was no sector in which Mexico's share increased and China's simultaneously decreased. In fact, Mexico was losing share in several sectors in which China was gaining participation. In contrast, during 2010–12 (bottom panel) there are several sectors in which Mexico's share increased while China's fell. In addition, the number and relative importance of sectors in which China's share went up and Mexico's declined in the most recent period.

Chart 2 shows the changes in Mexico's market share of U.S. imports against those of China in each of the 26 manufacturing sectors, for the periods 2005–07 and 2010–12. We excluded 2008 and 2009 because the global economic crisis distorted trade worldwide. In each panel, the upper left quadrant (red bubbles) represents sectors in which China's market share increased while Mexico's fell; the lower right quadrant (green bubbles) plots sectors (if any) in which Mexico's share increased and China's fell. The other two quadrants depict sectors in which the shares for both countries either fell or increased simultaneously. The size of the bubbles is proportional to each sector's contribution to the overall change in market share in each period. During 2005–07 (top panel) there was no sector in which Mexico's share increased and China's simultaneously decreased. In fact, Mexico was losing share in several sectors in which China was gaining participation. In contrast, during 2010–12 (bottom panel) there are several sectors in which Mexico's share increased while China's fell. In addition, the number and relative importance of sectors in which China's share went up and Mexico's declined in the most recent period. Wages in the manufacturing sector in China increased at an average annual rate of 14 percent in renminbi terms from 2003 to 2011, and close to 20 percent annually in dollar terms (which reflects both nominal wage growth and the appreciation of the Chinese currency). In contrast, average wages in the Mexican manufacturing sector have remained fairly constant in dollar terms, underpinned by moderate wage growth and a depreciation of the peso. In 2003, average dollar wages in Mexico were six times higher than those in China; in 2011 wages were only 40 percent higher (see Chart 3). This has reduced the competitive advantage that China had as a low-cost supplier of manufacturing goods to the United States in the early part of the 2000s. (Because reliable data on unit labor costs in the Chinese manufacturing sector are not available, we could not account for changes in productivity in manufacturing and how much they contributed to wage changes.)

Wages in the manufacturing sector in China increased at an average annual rate of 14 percent in renminbi terms from 2003 to 2011, and close to 20 percent annually in dollar terms (which reflects both nominal wage growth and the appreciation of the Chinese currency). In contrast, average wages in the Mexican manufacturing sector have remained fairly constant in dollar terms, underpinned by moderate wage growth and a depreciation of the peso. In 2003, average dollar wages in Mexico were six times higher than those in China; in 2011 wages were only 40 percent higher (see Chart 3). This has reduced the competitive advantage that China had as a low-cost supplier of manufacturing goods to the United States in the early part of the 2000s. (Because reliable data on unit labor costs in the Chinese manufacturing sector are not available, we could not account for changes in productivity in manufacturing and how much they contributed to wage changes.) in relative market share and the relative importance of labor in the production process.

in relative market share and the relative importance of labor in the production process. According to the 2011 U.S. Manufacturing-Outsourcing Cost Index (AlixPartners, 2011), goods produced in Mexico had the lowest landed costs (that is, their price at a California port) for U.S. importers in 2010 of all key low-cost outsourcing countries (see Chart 5). At the same time, U.S. producers have begun to "near-shore" their inputs—that is, buy them from a close, rather than distant, source, which enhances Mexico's advantage as a nearby manufacturing hub. Non-U.S. companies have also pulled up stakes in China and relocated their production to Mexico.

According to the 2011 U.S. Manufacturing-Outsourcing Cost Index (AlixPartners, 2011), goods produced in Mexico had the lowest landed costs (that is, their price at a California port) for U.S. importers in 2010 of all key low-cost outsourcing countries (see Chart 5). At the same time, U.S. producers have begun to "near-shore" their inputs—that is, buy them from a close, rather than distant, source, which enhances Mexico's advantage as a nearby manufacturing hub. Non-U.S. companies have also pulled up stakes in China and relocated their production to Mexico.

.png)