Mexico has re-entered Kearney’s Foreign Direct Investment (FDI) Confidence Index, securing the 21st spot among 25 countries in 2024. This comeback, the first since 2019, underscores Mexico's importance in the trend towards nearshoring, notably towards the United States.

Kearney’s Index Insights: Mexico Versus Global Dynamics

Mexico's ascendancy on the index, surpassing Taiwan—a region previously underscored by U.S tech giants for supply-chain vulnerabilities—underscores the shifting dynamics in global manufacturing and supply chains. Kearney’s insights reveal that Mexico's geographical proximity to the U.S., a burgeoning consumer market, and a skilled labor force are pivotal factors enticing companies to consider Mexico as a strategic hub for setting up manufacturing operations in Mexico and optimizing supply chains amidst the challenges posed by longer global supply routes, especially in the tech sector dominated by Asian production.

In a move reflective of this shift, notable U.S. tech firms have reportedly encouraged their Taiwanese manufacturing counterparts to amplify AI-related hardware production in Mexico, aiming to mitigate risks and capitalize on the proximity advantages Mexico offers.

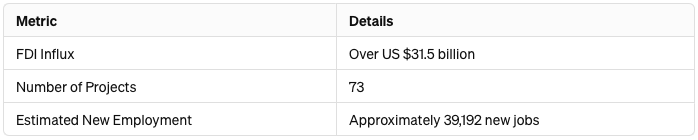

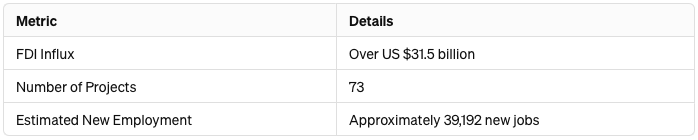

A Surge in Investment and Job Creation

Mexico's FDI landscape in the early months of 2024 has been nothing short of remarkable. The Economy Ministry of Mexico (SE) announced an influx of over US $31.5 billion in FDI, with significant contributions from leading corporations such as FEMSA, Amazon, DHL Supply Chain, and Ternium. This investment boon is not just a testament to Mexico's economic allure but also a job creation engine, with 73 projects expected to generate approximately 39,192 new employment opportunities.

The diversification of investment sources further highlights Mexico's global appeal, with the United States, Germany, and Argentina leading the investment charge, complemented by a rising interest from Chinese companies. This influx is predominantly benefitting the manufacturing sector in Mexico, which accounts for over half of the total FDI announcements, spotlighting the automotive industry as a significant beneficiary and job creator.

Reshoring and Mexico’s Strategic Advantage

Kearney's report positions Mexico as a linchpin in the reshoring trend, benefiting from a concerted shift by manufacturing entities from Asia in a bid to hedge against transportation costs, customer service agility, and geopolitical uncertainties. The strategic repositioning towards Mexico, especially in manufacturing, reflects a broader acknowledgment of the country's capacity to serve as a reliable and efficient link in global supply chains, particularly for the North American market.

Article: Reshoring Trend Continues: U.S. Manufacturing Companies Leaving China

Regional Growth and Strategic Development

The concentration of investments across key states like Querétaro, Nuevo León, and Puebla, coupled with strategic initiatives like the Interoceanic Corridor of the Isthmus of Tehuantepec and the Maya Train project, emphasizes the regional distribution of growth opportunities within Mexico. Furthermore, the country's notable performance as one of the world’s top exporters in 2023, climbing to ninth place, alongside its standing as the 12th largest economy as per the IMF, solidifies its global economic stature.

Mexico's Ascending Role in Global Trade and Investment

Mexico's FDI achievements in 2023, amounting to $36.058 billion—a 27% increase from the preceding year—underscore a robust, competitive, and investor-friendly environment. The sustained focus on nearshore manufacturing, particularly in high-growth sectors like automotive, beverages, and electronics, positions Mexico as an attractive nexus for global investments, underpinning its economic resilience and potential for sustained growth.

In 2023, Mexico's exports increased by an interannual rate of 2.6%, reaching a total of US$593,012 million. This growth enabled Mexico to surpass the export levels of Russia, Canada, Hong Kong, and Belgium, all of which experienced declines in their respective export figures over the same period.

China maintained its position at the top of the global rankings with exports totaling US$3.4 trillion, followed by the United States with US$2 trillion, and Germany with US$1.7 trillion.

"We already began to tangibly see in 2023 the effect of the relocation or growth of production lines in some plants that already existed; new investments may begin to arrive in 2024 or 2025," said Israel Morales, Director of the National Committee on Mexico-United States Relations and International Agreements of the National Council of the Maquiladora and Export Manufacturing Industry (Index).

As Mexico navigates the evolving global economic landscape, its strategic advantages in location, labor, and market access, coupled with a conducive policy environment, continue to draw foreign investor confidence. The country’s resurgence in Kearney's FDI Confidence Index not only highlights its intrinsic value propositions but also signals a broader shift towards nearshoring as a pivotal strategy in the post-pandemic era of global trade and investment.

As the landscape of global manufacturing continues to evolve, the opportunity to leverage Mexico's strategic advantages has never been more appealing. Co-Production International stands at the forefront, ready to guide businesses through the intricacies of starting or expanding their manufacturing footprint in Mexico. Whether you're looking to optimize your supply chain, reduce operational costs, or tap into a skilled labor market, our team is here to make your transition as seamless as possible. Contact us today to learn more about how we can help turn your nearshoring aspirations into reality.

.png)