NAFTA has improved the economies of its three member nations, added millions of new jobs and created a successful and profitable atmosphere of cooperation. Since its inception in 1994, imports and exports have quadrupled, foreign direct investment grows in billions every year, and manufacturing has become a cooperative effort where products are built from multi-origin parts.

Businesses faced with global competitiveness have not only stayed in business, but have expanded capabilities and increased their profit margins, all while being able to hire more people and innovate in their industries like never before. While headlines continue to include words like “worry” and “uncertainty” in regards to President Trump’s position on NAFTA and trade with Mexico, the reality of free trade and the interwovenness of North America’s economies is a testament to the success of international trade.

“Forty million U.S. jobs depend on international trade.” - Tom Donahue, President, US Chamber of Commerce

Benefits of NAFTA

President Trump made two very big promises during his campaign that relate to trade with Mexico: to build a wall on our southern border and to withdraw from NAFTA. In his first few days in office he has attempted to make good on them. Sort of. To believe he will actually make good on them, you have to believe his reasoning behind these promises and therein lies the problem. Actual facts run contrary to his reasoning and rhetoric.

NAFTA has been a success for the U.S. economy. According to U.S. Chamber of Commerce president and CEO Tom Donohue, “40 million U.S. jobs depend on international trade,” of which 14 million U.S. jobs depend on trade with Canada and México (i.e. under NAFTA.)

The U.S.’s trade relationship with México (and Canada) has not been unfair or unbalanced, as it has been frequently characterized. As Canada’s Agriculture Minister Lawrence MacAulay said earlier this month when asked about President Trump’s threats to withdraw from NAFTA, “I’m sure Trump knows how important money is. Both governments and industry in both countries and Canadian and American citizens understand this, so I would be surprised if anyone is going to try to destroy that system of making money.”

How NAFTA Has Benefited the U.S.

México is the United States’ third-largest trade partner, accounting for $1.5 billion in bilateral trade every day.

14 million U.S. jobs depend on trade with Canada and Mexico, according to the US Chamber of Commerce.

The United States is, by far, Mexico’s leading partner in merchandise trade. U.S. exports to México increased rapidly since NAFTA, from $41.6 billion in 1993 to $240.3 billion in 2014, an increase of 478%, according to the Congressional Research Service.

23 U.S. states send more than half of their exports to Mexico, according to the Transborder Institute.

México buys more goods and services from the U.S. than all of Europe combined, according to the Transborder Institute.

Goods from México and Canada represent about 75% of all the U.S. domestic content that returns to the United States as imports.

Severe Impact on U.S. Makes NAFTA Withdrawal Unlikely

President Trump has zeroed in on the loss of U.S. manufacturing jobs as the reason why NAFTA is unfair to the U.S. So if the U.S. withdraws from NAFTA, would that actually bring manufacturing jobs back home?

Not so, says the Center for Automotive Research (CAR). In fact, more U.S. jobs would be lost in the automotive sector should his plans to withdraw from the treaty come to fruition. According to CAR’s report released this month, “for instance, a 35 percent tariff on vehicles imported from México would result in the loss of at least 6,700 North American assembly jobs and 450,000 units of U.S. auto sales.”

“Because Mexican-made vehicles are made of about 40 percent American parts on average, and American-made vehicles are made of about 12 percent Mexican parts, about 20,000 U.S. parts manufacturing jobs and 11,000 U.S. assembly jobs could be lost as a result. And those job losses could multiply due to other factors,” the CAR report explained further.

And this isn’t just about U.S. auto jobs, it’s also about parts and supply. The CAR report noted that U.S. suppliers would also be threatened as the U.S. exported $22 billion in parts to Canada in 2015 in addition to $20 billion to Mexico.

“Mexico's manufacturing industry carries a significant weight with the US economy, creating jobs on both sides of the border.” - Enrique Esparza, President, Co-Production International

The CAR report attributes North America’s automotive industry competitiveness to NAFTA and Mexico, highlighting, "Without NAFTA, large segments of the U.S. automotive industry would have moved to other low-wage countries in Asia, Eastern Europe, or South America. By producing cheaper automotive parts and components on the 'near shore' in México rather than truly 'off-shore,' Mexican automotive plants helped sustain a competitive automotive industry across North America."

The Services Sector Under NAFTA

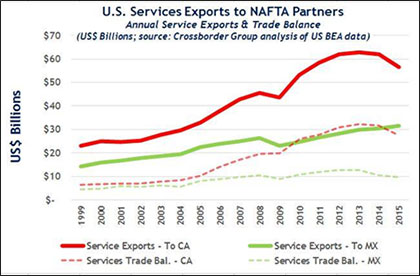

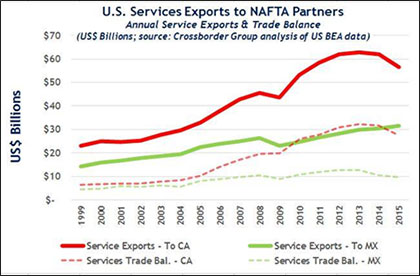

The automotive industry is just one example in the myriad of facts that run contrary to President Trump’s reasoning. The Crossborder Group, a market research firm specializing nearshore and binational markets, has highlighted what has been overlooked by President Trump’s sensationalized lambasting of NAFTA: the services sector in international trade.

The automotive industry is just one example in the myriad of facts that run contrary to President Trump’s reasoning. The Crossborder Group, a market research firm specializing nearshore and binational markets, has highlighted what has been overlooked by President Trump’s sensationalized lambasting of NAFTA: the services sector in international trade.

“In 2015 alone, US services exports to Canada and México were valued at nearly $88 billion ($56.4B to Canada, $31.5B to Mexico), with a POSITIVE net trade balance of $37 billion (i.e.: the US exported more services to them than were imported).” - Crossborder Group

“For decades, the US economy has been shifting from one oriented toward agriculture and manufacturing toward services - yet, nearly all of the public discourse about trade has focused on manufacturing jobs. The reality is that NAFTA also has helped US firms to grow their exports for services - and, in fact, Canada and México are historically top export markets for US services firms: Canada typically ranks #1 or #2, and México has lately ranked #6,” says the Crossborder Group.

NAFTA Renegotiation the Likely Route

“NAFTA is an agreement that has been around for about 20 years or so. I think it will be healthy to review it and to make sure that all the participants are getting their fair share. There are changes that could be made to reflect the world we live in now,” says Enrique Esparza, President of Co-Production International, a shelter services provider for manufacturing in Mexico, Co-Production International.

To drive home the point that NAFTA would benefit from a review and update, the 2015 Congressional Research Service report on NAFTA concluded, “Both proponents and critics of NAFTA agree that the three countries should look at what the agreement has failed to do as they look to the future of North American trade and economic relations. Policies could include strengthening institutions to protect the environment and worker rights; considering the establishment of a border infrastructure plan; increasing regulatory cooperation; promoting research and development to enhance the global competitiveness of North American industries; investing in more border infrastructure to make border crossings more efficient; and/or creating more efforts to lessen income differentials within the region.”

Everyone seems to agree, renegotiation is going to be the most likely route. With so many stakeholders, U.S. cities and their entire economies dependent on efficient, free trade, it will be hard for the Trump Administration to unilaterally pull out of the treaty.

For more information, or if you are interested in developing an analysis that shows the cost of manufacturing in Mexico call (858) 427–8514

The automotive industry is just one example in the myriad of facts that run contrary to President Trump’s reasoning. The Crossborder Group, a market research firm specializing nearshore and binational markets, has highlighted what has been overlooked by President Trump’s sensationalized lambasting of NAFTA: the services sector in international trade.

The automotive industry is just one example in the myriad of facts that run contrary to President Trump’s reasoning. The Crossborder Group, a market research firm specializing nearshore and binational markets, has highlighted what has been overlooked by President Trump’s sensationalized lambasting of NAFTA: the services sector in international trade.

.png)