The landscape of North American manufacturing has shifted. Mexico is no longer just a cost-effective alternative to domestic production;

it has become the world’s most strategic manufacturing hub for the U.S.

market. As Nearshoring reaches record levels, so does the scrutiny from trade authorities.

The U.S. Trade Representative (USTR) and Customs and Border Protection (CBP) have placed a spotlight on a practice known as "Triangulation"—the attempt to bypass Section 301 tariffs on Chinese goods

by routing them through Mexico with minimal transformation. For global manufacturers, understanding the "Tariff Effect" is not just about logistics; it is a matter of protecting your long-term investment.

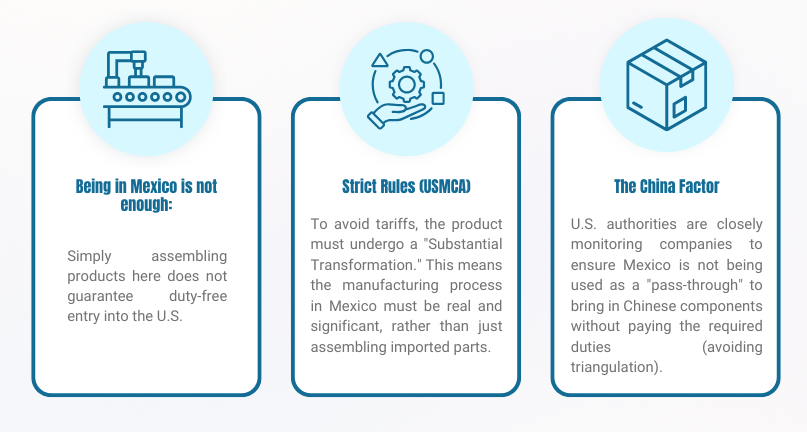

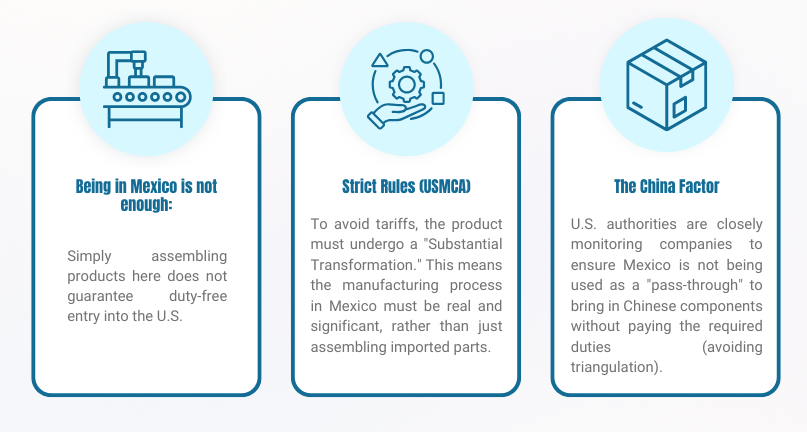

There is a common misconception in the boardrooms of many international corporations: the belief that simply moving a production line to Mexican soil automatically qualifies the finished product for

duty-free entry into the United States.

Under the United States-Mexico-Canada Agreement (USMCA), the rules of origin are more stringent than ever. To qualify for preferential treatment, products must undergo a "Substantial Transformation."

This means the manufacturing process in Mexico must be significant enough to change the tariff classification of the imported components or meet a specific percentage of Regional Value Content (RVC).

The geopolitical tension between the U.S. and China has led to the implementation of Section 301 tariffs. As companies seek to mitigate these costs by moving to Mexico, U.S.

authorities are vigilant against "pass-through" operations. If your plant is merely an assembly point for a kit of 100% Chinese parts, you are at high risk of being flagged for triangulation.

For an executive, the technicalities of customs law can be overwhelming. However, two concepts are critical to grasp:

This rule requires that the foreign materials used in the production of a good undergo a change in their Harmonized System (HS) tariff classification as a result of the work performed in Mexico.

If you import raw plastic pellets (one HS code) and export a molded medical device (a different HS code), you have likely achieved a tariff shift.

Even if a tariff shift occurs, some products—especially in the automotive and electronics sectors—must also meet an RVC threshold. This is calculated using two primary methods:

- Transaction Value Method: Based on the price paid for the good.

- Net Cost Method: Based on the total cost of production minus non-allowable costs like promotion and royalties.

The Risk of Failure: If your product fails these tests, it is treated as a product of its original source (e.g., China), making it subject to the very tariffs you moved to Mexico to avoid.

The "Tariff Effect" isn't just a potential tax; it’s a legal minefield. When the CBP initiates an audit, they don’t just look at today’s shipment; they look at years of records.

- Retroactive Tariffs: If a violation is found, authorities can demand payment for tariffs on all shipments made over the past several years. For a high-volume manufacturer, this can amount to

tens of millions of dollars, potentially bankrupting a subsidiary.

- Seizure of Goods: Ongoing shipments can be detained at the border, causing catastrophic delays in your supply chain and damaging relationships with U.S. retailers or OEMs.

- Loss of Credibility: Once a company is flagged for non-compliance, every future shipment will be subject to "Red Lane" inspections, adding time and cost to every delivery.

To build a resilient operation in Mexico, Co-Production International recommends a three-pronged strategy:

Compliance cannot be generalized. Every SKU (Stock Keeping Unit) must be analyzed individually.

- Bill of Materials (BOM) Audit: Trace the origin of every nut, bolt, and resin.

- Cost Analysis: Ensure that labor, overhead, and North American components outweigh the value of non-regional materials.

- Expert Consulting: Use trade experts to validate your findings before the first shipment crosses the border.

The ultimate defense against the "Tariff Effect" is localization. By developing a base of North American suppliers, you not only ensure USMCA compliance but also:

- Reduce Lead Times: Shipping from Queretaro to Texas is faster than shipping from Shanghai to Long Beach.

- Mitigate Geopolitical Risk: You are no longer vulnerable to sudden tariff hikes or port strikes across the Pacific.

- Lower Carbon Footprint: Shorter shipping distances align with modern ESG (Environmental, Social, and Governance) goals.

In a trade audit, your word is worth nothing without documentation. You must maintain an "Audit-Ready" digital ecosystem.

- Certificates of Origin: Validated and up-to-date certificates from every supplier.

- Production Logs: Evidence that the transformation actually took place in your Mexican facility.

- Financial Records: Proof of the "Net Cost" calculations used for RVC.

It is important to emphasize that these regulations are not designed to hinder Mexican manufacturing. On the contrary, they are designed to protect it. By enforcing strict rules of origin, the

USMCA ensures that the economic benefits of trade stay within the North American bloc.

Mexico has spent decades building a sophisticated industrial ecosystem. From advanced aerospace manufacturing in Chihuahua to automotive excellence in the Bajio region, Mexico offers:

- High-Skilled Labor: A workforce capable of complex transformation, not just simple assembly.

- Infrastructure: World-class industrial parks with specialized customs handling.

- Legal Framework: A stable treaty environment that provides a clear roadmap for long-term growth.

Navigating the complexities of the Mexican legal and fiscal system while simultaneously ensuring USMCA compliance is a massive undertaking. This is where the Administrative Shelter

Program becomes an invaluable asset.

Under a Shelter, Co-Production International (CPI) becomes the "Employer of Record" and the "Importer of Record" in Mexico. We don't just provide space; we provide a protective umbrella of compliance.

How CPI Protects Your Operation:

- IMMEX & VAT Certification: We manage the programs that allow you to import raw materials tax-free for transformation and export.

- Trade Compliance Department: Our experts monitor every shipment, ensuring that all paperwork is flawless and that RVC requirements are consistently met.

- Risk Management: We stay ahead of legislative changes in both Mexico and the U.S., so you can focus on what you do best: manufacturing.

The "Tariff Effect" is a reality of modern global trade. While the scrutiny on China-Mexico-U.S. triangulation is increasing, it should not deter companies from moving to Mexico. Instead, it should encourage them to do it right.

Nearshoring to Mexico is the most significant competitive advantage available to manufacturers today. By committing to genuine transformation, localizing supply chains, and partnering with experts like Co-Production International, your company can reap the rewards of the North American market while remaining completely protected from tariff risks.

Mexico is not a loophole; it is the future of global manufacturing.

.jpg)

.png)